TEE Land is a property developer with an established track record in delivering quality and well-designed residential property developments in Singapore. TEE Land property development projects are pre-dominantly freehold in tenure and are targeted at middle-to-high income consumers who value exclusivity in good locations. Whilst the company continue to specialize in residential property developments, it is expanding into commercial and industrial property development projects. Leveraging on the TEE Land experience and expertise in property development in Singapore, the company have also extended their geographical reach to Malaysia, Thailand and Vietnam.

Forecast Dividend Yield:

2012: 0.32%*

2013: No Forecast

*Based on issue price of $0.54, 446,876,000 units after IPO, profit after tax of $1.521 million in 2012 and minimum 50% profit distribution policy.

Dividend Policy:

Strength

-Property developer with an established track record.

-Property developer with an established track record.

-Expanding beyond residential property development and have a regional presence in South-East Asia.

-Focus on quality residential property development and expanding into commercial and industrial property development.

-Expanding into new markets

Weakness

-Subject to various government policies which regulate the property market in Singapore (Between September 2009 and January 2013, the Singapore government implemented 7 rounds of property curbs and cooling measures to keep the buoyancy of the property market in check)

-May be affected by the political, economic and social conditions in the countries (Malaysia, Thailand and Vietnam) that the company operate in

-Subject to risks associated with debt financing

-Operating in a highly competitive industry in Singapore, restricting the company to offer competitive pricing to buyers

-Subject to fluctuations in the costs of construction materials, labour and equipment. As announced in the Singapore government’s Budget 2013, there will be further increases in foreign workers levies in addition to the increase in levies which was previously announced in the Singapore government’s Budget 2010, Budget 2011 and Budget 2012. In the Singapore government’s Budget 2012, the MOM announced a further 5% cut in the MYE quota for new projects with effect from July 2012. This is in addition to the 15% cut in the MYE quota for new projects with effect from July 2013 as announced in the Singapore government’s Budget 2011 and the reduction in the MYE quota by 25% over three years for the construction sector as announced in the Singapore government’s Budget 2010. (This will be a killer)

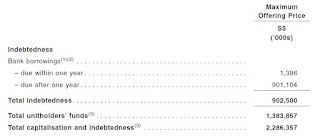

-High Gearing of 35.58%

Based on the above information, I will give this counter a miss. The revenue from the company is highly unstable ($23 million in 2011 VS $8 million in 2012), which will directly have an impact on its profit. The issue price of $0.54 is way too high, putting it at an astonishing PE of 158. From 2012 results, using the 50% dividend distribution policy for 2013, the equation just work out to be 0.32%, which is pathetic. HY2013 audited results are not very promising either. Post IPO, the gearing of the counter will remain to be high (Gearing of 35.58%), so if there is future acquisition, it will most likely have to issue new shares, resulting in share dilution.

Some useful information:

[30 May 2013], [9.00 a.m.] : Opening date and time for the Public Offer.

[04 Jun 2013], [12.00 noon] : Closing date and time for the Public Offer.

[05 Jun 2013]: Balloting of applications under the Public Offer, if necessary.

[06 Jun 2013], [9.00 a.m.]: Commence trading on a “ready” basis.

Rating for investment: 1/10

Disclaimer: You may use the above information as a guide, but please invest based on your own judgment.