Short Summary:

Linc Energy is a company focused on both conventional and unconventional oil and gas production. The company own a diverse and substantial energy portfolio that includes oil, gas, shale oil and gas and coal. The company operate in the following three key business divisions with offices headquartered in different geographic locations:

(a) conventional oil and gas, which consists of:

- Oil and gas producing assets located in two main areas in the United States, namely, the Gulf Coast Region and Wyoming, which contribute the bulk of the company revenue; and

- The appraisal and development of the Umiat field located in Alaska, the United States;

(b) unconventional oil and gas, which consists of:

- Clean Energy business, which focuses on the commercialization of the company proprietary technology in underground coal gasification (“UCG”), the process of converting coal into valuable UCG synthetic gas (“syngas”) in situ. The company Chinchilla demonstration facility, in Australia (the “Chinchilla Demonstration Facility”), is the only UCG to gas-to-liquids (“GTL”) demonstration facility operating in the world. The company also own and operate the world’s longest running commercial UCG operation in Uzbekistan, having been in operation for over 50 years, and which supplies energy to a nearby power station. The company hold coal interests for UCG in Wyoming and Alaska in the United States, Poland, Uzbekistan, and South Australia and Queensland in Australia; and

- SAPEX business, which focuses on the exploration for shale oil and gas in the Arckaringa Basin in South Australia; and

(c) coal, which consists of:

- A financial asset in the form of a contractual right to receive payments from coal production over the Carmichael Project in Queensland, Australia (the “Carmichael Royalty”)(Expected commencing in 2017); and

- Conventional coal mining business, which consists of interests in conventional coal mining assets in Queensland, Australia.

The Deal:

Offering Price: S$1.20

The Offering: 47,850,000 Shares (Include 500,000 Offering Shares to Singapore Public)

Cornerstone Investors:

47,850,000 Genting

23,925,000 Russian billionaire Roman Abramovich

Forecast Dividend Yield:

2013: 0%

2014: No Forecast

2015:No Forecast

*Based on issue price of $1.20, 571,150,642 units after IPO.

Dividend Policy:

On 31 August 2010, the Company declared a fully franked special dividend of A$0.10 (US$0.10) per Share which was paid on 8 October 2010. Since 9 October 2010, the company have not declared or paid any further dividends. While the company currently do not have a formal dividend policy, it intend to reinvest any profits generated from their operations in the business. Subject to the Corporations Act, the company Constitution and the terms or rights of any Shares with special rights to dividends, the Board may from time to time resolve to pay dividends to Shareholders. The form, frequency and amount of future dividends on the Shares will depend on the company retained earnings and expected future earnings, general business and financial position, results of operations, capital requirements, cash flow, general financing condition, and other factors which our Directors may deem appropriate. Therefore, there can be no assurance that dividends will be paid in the future or of the amount or timing of any dividends that will be paid in future.

Strength

-Diversified energy company with operating control of a global portfolio of conventional and unconventional oil, gas and coal assets and proven UCG technology ready for commercialization

-High quality, low risk, oil levered production with potential significant production upside from assets currently under development and from exploration

-Strategically positioned and equipped to capitalize on robust demand for oil and gas in Asia; particularly the switch from oil and coal to gas in regional markets. High relevance of the Company’s proprietary UCG technology to the Asia energy market given the large number of potentially suitable coal resources in Asia, namely in China, Mongolia and Indonesia.

-Leader in UCG technology. Believed to be the only company in the world to have demonstrated UCG to GTL, and to have produced diesel and jet fuel from UCG syngas, providing first mover advantage in the UCG front.

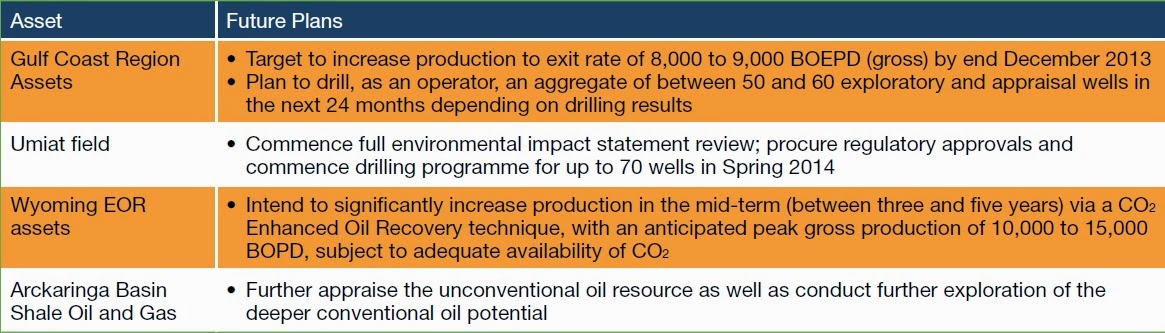

Business Strategies and Future Plans

-Be a leader in provision of clean energy through UCG and GTL whilst deploying UCG technology to penetrate new markets and grow the company asset base (Pursue joint ventures, Enter into licensing agreements)

-Grow Asian footprint

Weakness

-Exploration and development involves numerous risks and substantial and uncertain costs that may not yield desired results, resources or reserves (Of the 11 assets listed, only 3 is in production, the rest are still in exploration phase)

-Oil, gas and coal operations involve many operational risks, some of which could result in substantial losses and unforeseen interruptions to operations

-The company may face difficulties obtaining financing for new projects, expansion and developments

-The existing debt instruments and revolving credit facility of the company have restrictions and financial covenants that may restrict business and financing activities

-The company may not be the operator on all of their future assets and therefore may not be in a position to control the timing of development efforts, the associated costs, or the rate of production of the reserves on such assets

-The company may pursue acquisitions which involve a number of risks, any of which could cause the company not to realise the anticipated benefits

-The company may be unable to dispose of non-strategic assets on attractive terms, and may be required to retain liabilities for certain matters

-The company are exposed to fluctuations in currency exchange rates

-The reserves and resources data for the company oil, gas and coal assets are estimates and may differ materially from the actual figures and may not ultimately be extracted at a profit

-High gearing of 50.64%

Phew..This IPO prospectus is exceptionally thick to read through. Imagine they have to split into 2 PDFs with a total of 500+ pages! All in all, I quite like Linc Energy for its diverse operations spread over major oil producing countries. Their revenue streams comes from a few different types of sources, namely conventional crude oil, clean energy and coal. Their clean energy of converting coal into valuable UCG synthetic gas without extracting the coal itself from underground is particularly interesting. As we all know, China and India is heavily dependent on coal for their energy source. If Linc is able to tap into these market, it can potentially be a major profit boost for the company going forward. I also like their royalty scheme (the “Carmichael Royalty”) with the coal developers. This will allow the company to have a stable source of income without exposing itself to the operation risk of coal mining. Linc Energy is not a new guy on the block. It has its history in Australia, just recently delist on ASX as the company claims that the investors in Australia is not valuating the company for its rightful worth and hence the switch to a Singapore listing. Although the company is making a loss for the last 2 years, this is typically the norm for a company whose majority assets is still in exploration phase (Just take a look at KrisEnergy and Rex International). Lastly, the names for its substantial shareholders speak for itself. Genting and the famous Russian oil businessman which is the owner of Chelsea, what more can you get?

Some useful information:

[11 Dec 2013], [9.00 p.m.] : Opening date and time for the Public Offer.

[16 Dec 2013], [12.00 noon] : Closing date and time for the Public Offer.

[17 Dec 2013]: Balloting of applications under the Public Offer, if necessary.

[18 Dec 2013], [2.00 p.m.]: Commence trading on a “ready” basis.

Rating for investment: 8.0/10

Disclaimer: You may use the above information as a guide, but please invest based on your own judgment.

_poster.jpg)