Asian Pay Television is a newly constituted Registered Business Trust formed to acquire its initial asset, the TBC Group. The TBC Group is Taiwan’s third-largest cable TV operator which operates exclusively in Taiwan, where it offers Basic Cable TV, Premium Digital Cable TV and Broadband services to households and businesses in five closely clustered and heavily populated franchise areas in northern and central Taiwan.

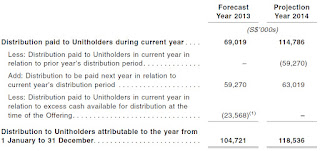

Forecast Dividend Yield:

2014: 6.94%

2015: 7.86%

*Based on maximum issue price of $1.00, 1,508,640,000 total units after over-allocation.

Dividend Policy:

100% distribution of its free cash flow

Strength

-Being only the 3rd largest operator, it still has room to grow the business before hitting the 33% market share limit imposed by the Taiwan government

-Have potential to further increase its basic Cable TV subscriber base by 121.3% from current level

Weakness

-Declining y-o-y operating profit due to cost rising at a faster rate than revenue

-Declining y-o-y average revenue per unit for Basic Cable TV and Broadband (representing 83.6% of revenue), possibly due to competition from competitors

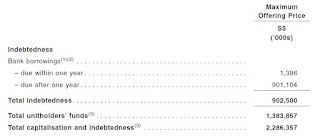

-Relatively high gearing at 39.47%

-Taiwan Dollars has depreciate against SGD over the last 10 years

-Taiwan NCC has rezoned the franchised area and competitors have bidded to operate in TBC group franchised area. There is no guarantee that these application will be successful at current stage, however, if competitors are successful, TBC will faced increased competition. (Pg 61 of preliminary prospectus).

-Taiwan is considering a new ruling to lower the barrier of entry for new operator (Pg 59 of preliminary prospectus).

In my opinion, I will give this IPO a miss. The forecast yield is not that attractive to start with and I see limited growth for the trust operator. If Taiwan government proceeds to open up franchise area for competition, it will likely result in price war where operator will start lowering package cost to attract subscribers. The decreasing y-o-y average revenue per unit for Basic Cable TV and Broadband (representing 83.6% of revenue) is also a big negative. With cost rising at a faster rate than revenue for the past 3 years, I have doubts if the trust will be able to perform at its forecast level. The depreciation of Taiwan Dollars against SGD doesn't help either.

Some useful information:

[16 May 2013]: Price Determination Date.

[17 May 2013], [9.00 a.m.] : Opening date and time for the Public Offer.

[27 May 2013], [12.00 noon] : Closing date and time for the Public Offer.

[28 May 2013]: Balloting of applications under the Public Offer, if necessary.

[29 May 2013], [2.00 p.m.]: Commence trading on a “ready” basis.

Rating for investment: 2/10

Disclaimer: You may use the above information as a guide, but please invest based on your own judgment.

No comments:

Post a Comment